On 11th March we published a report on the size and characteristics of the social enterprise sector. The report provides an update on the Social enterprise: market trends paper published in 2013. Government is an important source of data in this sector and reports such as these are valuable sources of information for policy makers and other stakeholders.

What are social enterprises?

There is no universal definition of a ‘social enterprise’. Most agree, however, that social enterprises are businesses who have a clear social or environmental mission and who reinvest their profits back into the business to achieve this mission. This definition is consistent with the one given by the national trade body for social enterprise, Social Enterprise UK. Social enterprises can sometimes take specific legal forms such as a Community Interest Company or Companies Limited by Guarantee. These are not a necessary feature of social enterprises but can create an ‘asset lock’ which ensures that profits are used for a social purpose.

What did the report find?

The report highlights some key characteristics of social enterprises in 2014, drawing comparisons between social enterprise employers and the general population of small and medium sized enterprise (SME) employers. These comparisons are intended to be useful to those wishing to better understand the comparative characteristics and experiences of social enterprises and will help to inform policy development for the social sector.

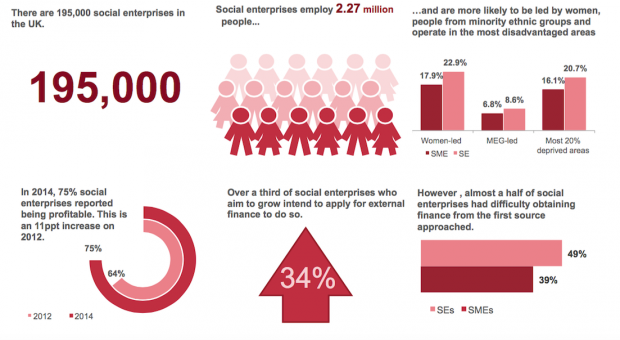

The report estimates that there were 195,000 social enterprise employers in the UK in 2014 and that social enterprises employed around 2.27 million people. Interestingly these enterprises were significantly more likely than SMEs overall to be led by women or a member of minority ethnic group and were more likely to be located in the 20% most deprived areas. The report also finds that social enterprises in 2014 were more likely to be profitable than in 2012. This is promising news for the social sector and suggests it is becoming more sustainable.

However, the report also indicates that social enterprise employers are significantly more likely to have difficulties accessing finance than other SME employers and are less likely to eventually obtain it. Forty-nine per cent experienced difficulty in obtaining finance from the first source they approached, compared to only 39% of SME employers overall. This could restrict the growth of the sector as over a third of social enterprises aiming to grow intended to apply for external finance to fund their growth.

Where did the data come from and how reliable is it?

The analysis is based on data gathered in the Small Business Survey (SBS) 2014 commissioned by the Department for Business, Innovation and Skills. This survey is not specifically targeted at social enterprises but every other year it includes a number of questions that allow certain SME employers to be classified as such.

The SBS has many advantages as a dataset. It asks a broad range of questions, with the full dataset containing roughly 800 variables. It is also a large survey with over 4,000 businesses participating, of which Cabinet Office classify about 700 as social enterprises. These sample sizes are large enough to give statistically significant results.

However there are some caveats to bear in mind. While the overall sample size is relatively large, some questions, such as those around access to finance, are only answered by a subset of SMEs and have a smaller sample size. These results should therefore be interpreted with some caution. Also, as there is no one definition of social enterprise, the results in the report may not be comparable with other reports on this sector.

What else is going on in the sector?

There is currently a lot of interest in social enterprise and social investment in the UK. The UK is considered to have the most developed social investment market in the world and this is reflected in the interests of consumers and investors. Consumer insights company Nielsen finds that 1 in 3 UK consumers are willing to pay more for socially responsible products and Morgan Stanley finds that 72% of active individual investors believe that companies with good environmental, social and governance practices are better long-term investments.

Recognising that social enterprises support growth and drive innovation, but have difficulties accessing finance, the UK government has played a role in expanding the social investment sector. It has had a social investment strategy since 2010 and the latest strategy outlines how the market has grown in recent years, as well as how further growth will be supported in 2016/17.

Most recently, the Minister for Civil Society has launched a review to examine how the related emerging sector of mission-led businesses can be supported. You can stay up to date with what the government is doing about social investment and social enterprise online.

Recent Comments